Owning a home is a primary goal for many, offering benefits like equity building and community stability. A primary challenge, however, for homeowners often isn’t just the fixed mortgage payment, but the variable annual expenses that can impact long-term affordability. This is even truer as one approaches retirement age when income stays flat but home expenses continue to grow.

Just as one must maintain a roof or HVAC system, it’s also vital to understand the financial mechanics of the property, specifically the impact of property taxes in your local county.

In many regions property taxes are the primary funding source for public services, schools, and infrastructure. As real estate markets fluctuate and property values rise, tax assessments often follow, sometimes catching owners off guard with increased property tax bills.

Understanding Property Taxes Near You

Navigating property taxes can be confusing. A simple breakdown reveals that a total tax bill is often an aggregate of rates from various jurisdictions, such as the city, the county, and the local school district. This complexity varies by region.

For example, understanding the specific landscape of your county requires knowing about unique local entities like Municipal Utility Districts, while other regions may have different special assessments like home exemptions, which can reduce your taxes significantly. Regardless of location, knowing exactly which entities are taxing the property is the first step toward financial control.

Pro Tip: Strategies to Control Costs

To maintain affordable housing costs, homeowners must be proactive. Paying the property tax assessment without review can often lead to overpayment. There are two universal methods to manage these costs effectively:

- Exemptions: Homeowners should verify they have filed for all available exemptions, such as a Residence Homestead Exemption. This typically removes a portion of the home’s value from taxation and may cap the amount the assessed value can increase each year.

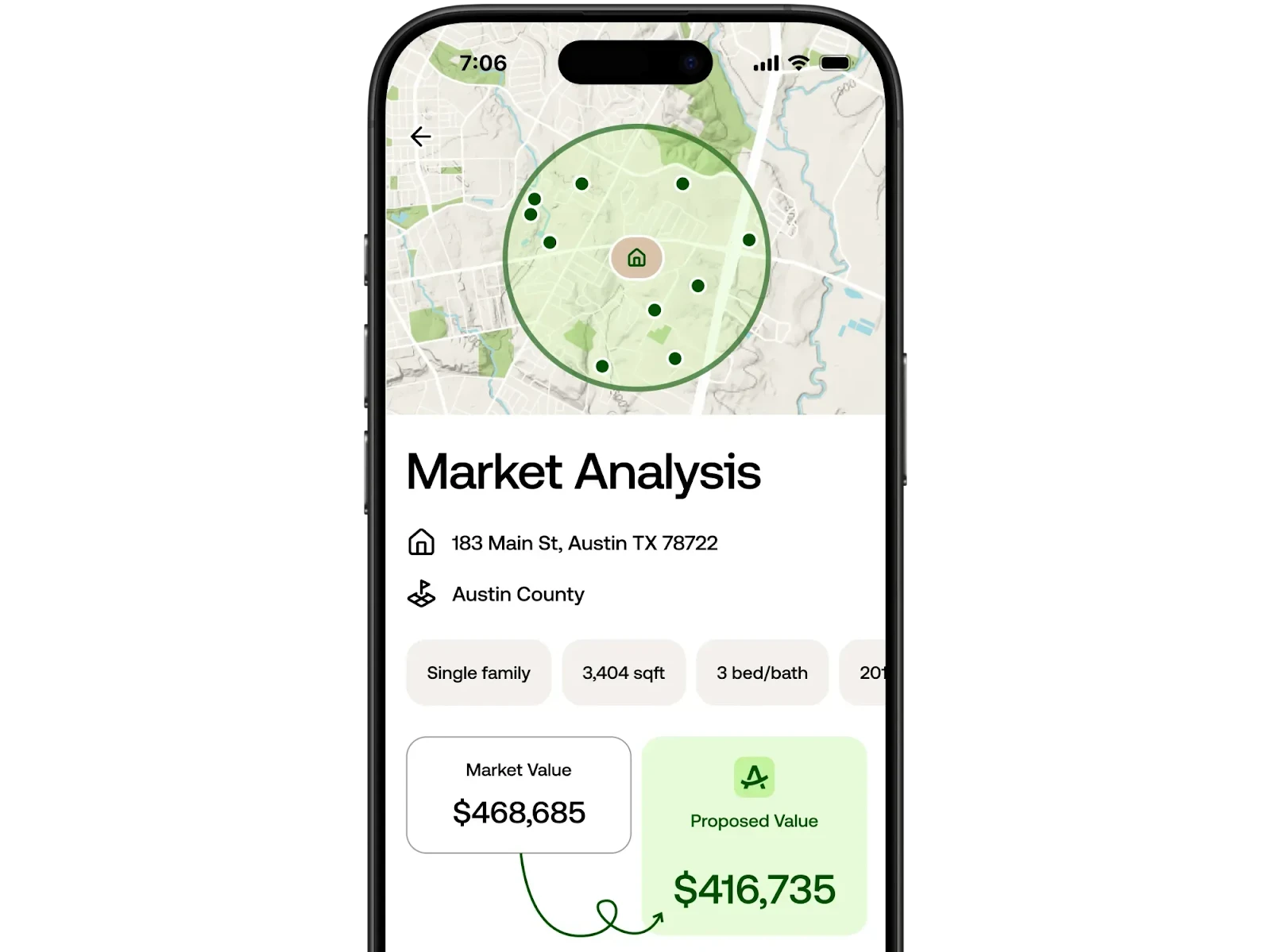

- Property Tax Protests: Local appraisal districts assess home values annually or biennially. Some states do it every two or four years, but the strategy works the same. If your property valuation assessment is higher than the actual market value, the property tax burden will be unfairly high. A comparative market analysis (CMA) is a standard tool used to determine a home’s true value in comparison to similar local properties. Having this and knowledge of the local tax market puts you leagues above the average homeowner.

Leveraging Data to Reduce Property Taxes

Many homeowners are intimidated by the property tax protest process, fearing it’s too complex and time-consuming. Challenging an unfair property tax assessment, however, is a pretty standard right of property ownership, and many counties have a process by which homeowners can submit appeals.

Leveraging data to engage in the property tax protest helps in understanding comparable sales in the neighborhood, enabling owners to build a strong case for a fair valuation. For those who find the manual research daunting, modern tools are available to help automate and manage this review process. Taking these steps is often the most effective way to save on property taxes significantly over the duration of homeownership.

By staying informed and proactive, owners can protect their financial health, ensuring that their investment remains a source of stability.