Are you intending to buy a house? If yes, you have two options: To either go for a newly constructed property or opt for an existing one instead.

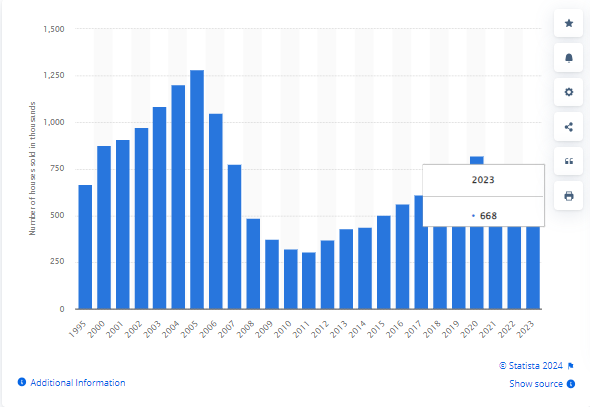

In recent statistics published by Statistica, over 668,000 units of new houses were sold across the United States in 2023, whereas 4.09 million existing homes got new owners over the same period.

The implication? That as much as older homes are more likely to attract buyers than their new counterparts, the question of what to choose between the two is still relevant.

So, what’s the best way for you to go? Should you go for a brand-new house or would you rather follow the way of the majority and buy a home that has been used before?

Well, if these are the questions you’re grappling with, there isn’t a one-size-fits-all answer. Both new and existing houses have their fair share of pros and cons that you should know for you to make the right decision.

In this blog post, we will examine some of the advantages and disadvantages associated with buying a new and existing home. That way, you can weigh out the two options and know what suits your needs better.

Understanding Old Vs. New Houses

Before we delve deep into the details of today's topic, let’s first define what we mean by an old house and a new house.

Basically, the difference between old and new houses lies in occupancy and their history.

Speaking of an old house, it simply means one that has been in use before. That’s to say it has at least had one previous owner occupy it.

A new house, on the other hand, is just that — a freshly constructed house that has never been occupied before.

In most cases, buying an old house may require you to do some renovation to bring it to code before moving in.Planning ahead can make selling your old house faster and easier, ensuring a smooth transition when the time comes to move on. Hiring a general contractor can ensure these updates are done professionally and meet current standards. However, in the case of new houses, they don’t need any renovation, so they’re ready to be occupied just as they are.

Advantages of Buying An Old House

Buying an old house might not sound like a good idea at first, but there are several advantages that you get by opting for previously owned homes.

Let’s examine some of the pros:

Old Houses Are Often Better Situated

If you’re looking for a new house, you should forget about finding one close to an urban center or next to public amenities. You might still find it, but the chances of that happening are very minimal.

But that’s not the case with old houses. In most cases, old houses have established neighborhoods and are found close to city centers where you can easily access public amenities such as restaurants, shops, hospitals, schools, and cultural attractions.

Plus, due to their established neighborhoods, older houses are often situated in areas with a strong sense of community and mature trees, making these houses generally more appealing to both families and individuals alike.

Aesthetics & Historical Charm

Of course, there’s a lot of charm and character that comes with older homes. That’s because most of these homes were constructed with durable materials using traditional methods, giving them a unique touch of aesthetics.

In fact, if you’re looking for homes that come with unique architectural designs, you will want to focus on older homes. They are even available in Victorians, Colonials, Tudors, and other architectural designs not replicated in modern construction.

Plus, older homes tend to come with original fireplaces, woodwork, and other unique features like crown molding. All these add warmth and character, giving older homes distinctive beauty.

Sure, some of these features are still available in some modern houses. But the thing is, they won’t give you the same level of charm and character as the older homes.

Potential for Appreciation

As stated earlier, most of the older homes are often located in close proximity to city centers and public amenities. Usually, these are areas that appreciate quickly in value as land becomes more scarce. This means older homes in such locations are likely to see faster appreciation compared to new houses often built in suburban areas.

Plus, older homes often offer room for renovation. Sure, revamping a house can be costly per se. However, statistics show that the returns you get from renovating your home far surpass the costs incurred.

On average, you can expect to get a return on investment (ROI) of 70% from renovating an older house. That means assuming you spend $50,000 on renovations, your home’s value would increase by $35,000 — resulting in a net gain of $35,000!

Affordability

One of the major advantages that you get from buying an older home is affordability. In most cases, older homes are priced lower than new houses, and this makes them a more attractive option for budget-conscious homeowners.

A recently published report shows that the median price of a new home is $355,400, whereas that of an existing home is slightly lower at $240,500. Of course, these rates may differ depending on your choice of location.

In addition, older homes usually provide a larger room for negotiation, as sellers are sometimes motivated to sell quickly due to maintenance concerns or other factors. While you may need to invest in renovations, the lower upfront cost alongside the ROI that comes with renovation can make it a worthwhile investment overall.

Cheaper dwelling options are starting to emerge such as accessory dwelling units and the Tesla tiny house.

Larger Plots of Land

Land continues to become more scarce as the population grows. That means houses being built are increasingly becoming smaller in average size.

According to statistics by the U.S. Census Bureau, a single-family home had a median floor area of 2164 square feet in the second quarter of 2024. That’s a decline from 2256 square feet recorded in the first quarter of 2023.

This means houses are generally shrinking over time. Hence, if you’re looking for a home with ample space, then you might want to focus on older homes. The larger space will give you the privacy you need and provide you with enough room for your space modifications and future expansion.

Disadvantages of Buying An Old House

As evident, there are many reasons most people choose to go for older homes than new ones. However, before you join the bandwagon, you need to also acquaint yourself with the disadvantages that come with choosing a previously owned home.

Higher Maintenance and Repair Costs

One of the major drawbacks to purchasing an older home is the increased likelihood of higher maintenance and repair costs. Older electrical systems may need extensive rewiring, which can be costly but is essential for safety and compliance. Homes built several decades ago often have worn-out features that require improvements.

Some of these improvements can be very expensive. Replacing roofing, cracks in a foundation, and replacing knob-and-tube wiring are prime examples of modifications that will cost you an arm and leg. Depending on the condition of the house, you might also need to replace outdated plumbing and electrical systems, as well as incur other recurring maintenance costs.

Hence, ensure that you do a thorough inspection before buying an existing home. You can do it yourself if you know what to check or find an expert to do the work for you if you don’t have the requisite skills.

Utility Costs

Older homes aren’t designed efficiently like the modern ones. You will need more energy to heat an older house in the winter and cool it down in the summer than you’d require with a new house. This can be expensive, especially considering that energy is a recurrent bill.

The U.S. Census Bureau’s American Housing Survey reveals that by opting for an older house, you might have to spend as much as 17% more on electricity and up to 38% on gas.

Fewer Safety Regulations

Construction safety standards have changed over time, and older homes often fall short of modern safety standards, which can be a significant drawback for potential buyers. Hiring a skilled contractor ensures that renovations are done professionally and to code, preserving the home’s value while addressing any safety concerns."

Many homes built before modern building codes were established may lack essential safety features such as smoke detectors, carbon monoxide alarms, and fire-resistant materials.

Additionally, older homes might not have features like reinforced foundations or seismic upgrades, making them more vulnerable in areas prone to natural disasters.

Of course, most of these safety measures can still be incorporated. However, bringing an older home up to modern safety standards can be costly and may require major renovations, adding both financial and safety concerns to the ownership experience.

Lack of Enough Storage Space

Another common disadvantage associated with older homes is that they might not have adequate storage spaces. That’s because user needs have increased with time, and we consume more stuff nowadays than ever before.

Therefore, most of the houses constructed many years ago may lack the capacity required to hold the amount of stuff we now have, even though they might have sufficed in the past.

This shortage of storage can be a challenge for families with growing needs or for individuals who value ample space for organization.

While solutions like adding built-in shelves or purchasing additional furniture can help, again these often come with added costs and may not fully address the underlying space constraints.

Advantages of Buying A New House

Now that we’ve seen the pros and cons of buying an older house, let’s switch and examine some of the advantages and disadvantages you should expect once you opt for a freshly constructed house.

New Houses Are Energy Efficient

The world is moving towards energy efficiency, and new houses are being designed to use less amount of energy than ever. These modern constructions come well-sealed and are usually equipped with more efficient HVAC systems and windows.

These features help keep energy spent at healthy levels, allowing you to direct your money to projects that matter the most.

On average, ultra-efficient homes will use 20% to 30% less energy than their traditional counterparts, with some even generating their own energy through the use of renewable energy sources like solar power.

Modern Design and Layouts

While older houses offer special charm and character through traditional architectural designs, not all of us prefer vintage designs for our homes. For instance, you may want a house with an open-concept floor plan, something that you’re not to find in older houses.

That’s where the need to go for contemporary designs comes in. Most of the modern houses come with open floor plans, which are highly desirable for entertaining and daily living.

These homes also include modern amenities like spacious master suites, walk-in closets, and dedicated home offices, offering comfort and convenience for today's homeowners. Buyers can also enjoy up-to-date finishes and technology, making new homes more functional and aesthetically pleasing without the need for immediate renovations.

Low Maintenance Costs

One of the biggest selling points of new homes is that they have minimal need for maintenance. Because everything from the roof to the plumbing is brand new, homeowners can avoid the costly repairs that are common in older homes.

In addition, some of the new homes even come with builder warranties covering major systems and appliances for several years. This provides peace of mind to new homeowners who don’t have to worry about immediate repair expenses.

In case your new home isn’t under warranty, experts recommend setting aside 1% to 4% of your home’s value for use as annual maintenance cost. With a new home, you should feel safer operating closer to 1%, while older homes might require you to work with the opposite end of that spectrum.

Customization Options

When buying a new home, many builders offer customization options. This means that buyers can select finishes, layouts, and fixtures that match their personal style, a privilege they often don’t get when purchasing a house that has previously been owned.

In fact, customization is one of the main reasons most home buyers opt for purchasing new homes instead of older ones. This ability to personalize the space ensures that new homeowners get exactly what they want right off the bat without the need for renovations.

Customization not only makes the house feel like home from day one but also adds long-term value by incorporating design elements that reflect current trends and technologies.

Smart Home Technology

The US smart home market has been steadily growing, as per Orbelo. Based on statistics, 69.91 million households in the US now use smart home devices in 2024. That's a 10.2% increase from what was recorded in 2023.

And mostly, it's the new homes that come with this technology. This could be in the form of built-in smart features like programmable thermostats, security systems, and lighting control, among other convenient features.

These technologies allow homeowners to manage their homes remotely, reduce energy use, and improve overall security. The integration of smart home technology is not only convenient but also adds to the home’s resale value, as these features are becoming increasingly sought after in the real estate market.

Modern Safety Standards

New homes are built according to the latest safety codes, providing a level of security that older homes may lack.

Builders are required to adhere to stringent regulations that address fire safety, structural integrity, and electrical systems, ensuring that modern homes are designed to protect their occupants. Features like smoke detectors, carbon monoxide alarms, and fire-resistant materials are mandatory in new constructions, reducing the risk of accidents and emergencies.

Additionally, newer homes are often equipped with advanced safety measures such as modern electrical wiring, circuit breakers, and reinforced structures to withstand natural disasters like earthquakes and storms.

These safety elements are not only comforting for homeowners but can also result in lower insurance premiums, as modern homes are less prone to risks like fire or structural damage.

Overall, the emphasis on safety in modern homes gives buyers peace of mind, knowing their living space meets the highest safety standards.

Disadvantages of Buying A New House

Like with buying an old property, there are a couple of disadvantages that come with buying a new house. Let’s look at some of these cons:

Underdeveloped Communities

Due to the growing land scarcity in urban centers, most of the new properties are available in undeveloped areas without established amenities such as schools, shopping centers, or public transportation.

Sure, while these areas eventually grow, more often that doesn’t happen soon, so it might take several years of longer commutes or fewer nearby conveniences. This can immensely impact the day-to-day quality of life, and especially if you have a larger family that might frequently need access to these facilities.

Higher Price Tags

One of the primary disadvantages that come with buying a new property is the higher upfront cost.

New homes tend to be more expensive than older ones, especially considering that they often aren’t as strategically placed as their older counterparts. The increase in cost is largely due to the appreciating land rates, the use of modern construction techniques, the incorporation of lots of convenience features, and others.

This high price tag, especially combined with the fact that new houses tend to be situated in underdeveloped areas, act as a major turn-off for potential homeowners, particularly those who are budget-conscious or want convenience.

Smaller Lot Sizes

As land becomes more expensive and urban areas become denser, new homes are often built on smaller lots. This reduction in outdoor space can be a drawback for families or individuals looking for a large yard, garden, or additional privacy.

Cookie-Cutter Designs

Most of the new homes are built as part of large developments, which can lead to neighborhoods where houses look almost identical.

Now, while some people might be okay with this uniformity, that’s not the case with most potential homeowners. This "cookie-cutter" style can feel impersonal and lack the unique character or charm often found in older homes. As such, for buyers who value architectural variety or individuality, this uniformity can be a disadvantage.

Is 2025 Going to Be a Buyer’s or Seller’s Market?

The real estate market fluctuates based on various factors such as interest rates, supply and demand, and economic conditions. While it’s difficult to predict with absolute certainty, experts are speculating that 2025 may present opportunities for both buyers’ and sellers’ markets.

According to Business Insider, 2025 is expected to favor the sellers’ market because home prices are predicted to continue escalating. However, that will happen at a slower rate than in recent years.

For buyers, the market may become more favorable due to projected drops in mortgage rates, making home ownership more affordable. Lower borrowing costs could help ease the financial burden for aspiring homeowners, creating a more balanced market environment.

Financing New Homes

Financing a home purchase, whether old or new, can be a complex process. Getting a mortgage rate quote can help you find the most favorable terms, ensuring that your investment remains within budget and aligns with your financial goals.There are several methods for financing a house purchase. Some of the most common financing methods include:

- Mortgage Loans: A mortgage is the most common way of acquiring a house. Options that you can use here include fixed-rate loans (steady payments) or adjustable-rate mortgages (lower initial rates that may fluctuate). FHA loans are suitable for first-time buyers, while VA loans cater to veterans with no down payment required.

- Government Programs: Programs for first-time homebuyers can assist with down payments and lower interest rates. USDA loans also provide low-cost options for buyers intending to acquire houses in rural areas.

- Savings and Assistance Programs: A larger down payment from personal savings can reduce the loan amount and eliminate the need for private mortgage insurance (PMI). Down payment assistance programs from state or local agencies can also help bridge financial gaps.

- Private Lenders and Retirement Funds: Private lenders, credit unions, and even borrowing against retirement funds (401(k) or IRA) are other ways to secure financing. Just ensure to understand the risks associated with each before you opt for one.

- Bridge Loans and Seller Financing: If transitioning from an existing property, a bridge loan can help cover the new purchase until your current home sells. Seller financing might be an option if traditional loans aren’t available.

Explore these options, compare lenders, and choose the best fit for your financial situation.

The Role of Home Renovation in Future Value

Home renovation remains one of the most potent tools for boosting a property's future value. This makes it a popular strategy, not just for homeowners but also for investors. So, how does renovation enhance the future value of a home?

Here are several ways:

- Increased Market Appeal: Renovations are a great and reliable way to modernize an outdated home, making it more attractive to potential buyers. Houses that have a fresh, updated look often sell faster and at a higher price, especially if they are designed to align with current design trends. Details like a bathroom wooden floor can also add warmth and charm, aligning with current design trends that boost a home’s appeal

- Functional Improvements: Adding or remodeling essential spaces, such as kitchens and bathrooms, significantly boosts a home's value. These are high-impact areas where functionality and style intersect, often delivering a strong return on investment.

- Energy Efficiency: Upgrades like better insulation, energy-efficient windows, and smart appliances can appeal to eco-conscious buyers. Lower utility costs can increase a home’s desirability, ultimately affecting the selling price positively.

- Enhanced Living Space: Expanding usable space, such as adding a new room or converting an attic into living space, adds value by increasing the home’s square footage, which directly impacts its market price.

- Preventing Depreciation: Regular updates and maintenance prevent a property from aging poorly, keeping it competitive in the market and reducing long-term repair costs.

Renovations, when carefully planned, directly contribute to increased resale value and enhanced comfort, making the investment worthwhile for future returns.

Conclusion

Deciding between an old house and a new one comes down to personal preferences, lifestyle needs, and financial goals.

Old homes offer charm, character, and established locations, but often come with higher maintenance and energy costs. On the other hand, new homes provide modern amenities, energy efficiency, and low maintenance, but they tend to have higher price tags and may lack individuality.

As the housing market evolves, it's important to consider long-term factors such as home appreciation, renovation potential, and financing options. Whether you're drawn to the history of an older home or the convenience of a new build, the key is to weigh the pros and cons carefully.

Ultimately, both options offer unique benefits, and understanding what matters most to you will help you make the right decision for your future home investment.