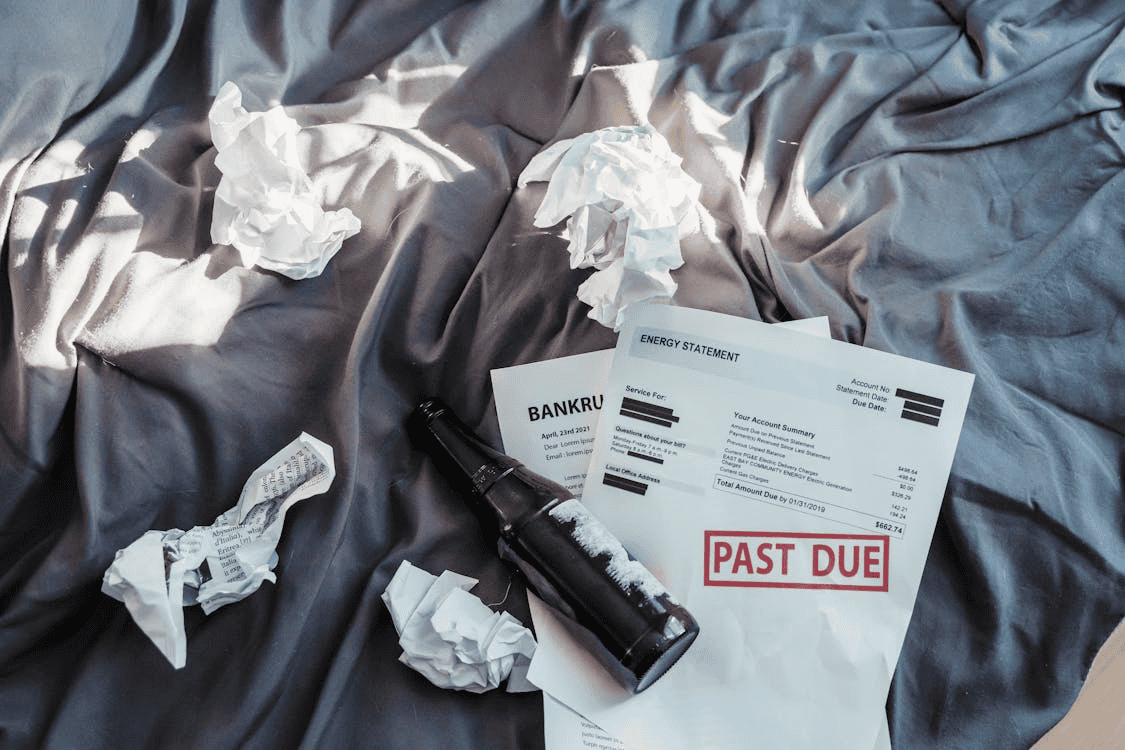

Money is tight for a lot of us right now, and it feels like everything costs more than it used to. Whether you’re trying to save a bit, cover rising bills, or just stop feeling broke by the end of the month, there are a few easy things you can do that actually help. You don’t need a full budget spreadsheet or to give up every little treat. These five tips are simple, doable, and make a real difference.

Track what’s going out

One of the easiest ways to make your money stretch further is to figure out where it’s disappearing. And no, just guessing doesn’t count. Go through your bank statements for the last month or two and add up how much you’ve spent on things like takeaways, random Amazon buys, subscriptions you forgot abo, it all adds up fast. Once you see where your cash is going, it’s way easier to spot what can be cut down. You don’t have to go full spreadsheet mode, just jot down the big things. Even shaving $50 a month off your spending gives you an extra $600 a year. That’s a holiday. Or heating. Or, you know, less stress.

Check if you’re eligible for support

If rising bills are eating into your budget, you’re not alone. Loads of people don’t realise they’re eligible for help with energy costs. One of the most useful things you can do is check out the HEAP application. It’s a program that helps people on a low income with utility bills, especially in winter when things really start to bite. It only takes a few minutes to check and apply, and it can make a massive difference to your monthly outgoings. Freeing up that money gives you breathing space in other areas too.

Buy second-hand more often

There’s no shame in shopping second-hand, and honestly, some of the best stuff comes with a little history. Whether it’s clothes, furniture, tech or even toys for the kids, sites like Vinted, eBay, and local Facebook groups are absolute goldmines. You can find decent-quality items for half the price or less. Plus, it’s better for the planet and stops you paying top dollar for something your child will forget about in two weeks. Win all round.

Meal plan

Groceries are one of those sneaky expenses that spiral if you’re not careful. You go in for milk, come out $40 lighter and no closer to an actual meal. Planning your meals for the week helps cut out those last-minute top-up trips and makes sure you’re actually using what you buy. It also helps when you’re feeling too tired to think about what’s for dinner because the decision’s already made. Add a couple of cheap go-to meals to the rotation and you’ll feel the difference.

Use cashback and loyalty schemes

If you’re spending money anyway, you might as well get something back. Sign up for cashback sites like TopCashback or Quidco, especially for bigger purchases or switching bills. It’s basically free money for doing nothing extra. Same goes for supermarket loyalty cards or apps that give you points or discounts. Just don’t get tempted to buy stuff you wouldn’t normally get just for the points. That defeats the whole point.